Key takeaways: Aligning payments to suppliers with reimbursements from payers is critical for healthcare organizations…

The Current State of Procure-to-Pay: Healthcare Suppliers Speak Out

Key takeaways:

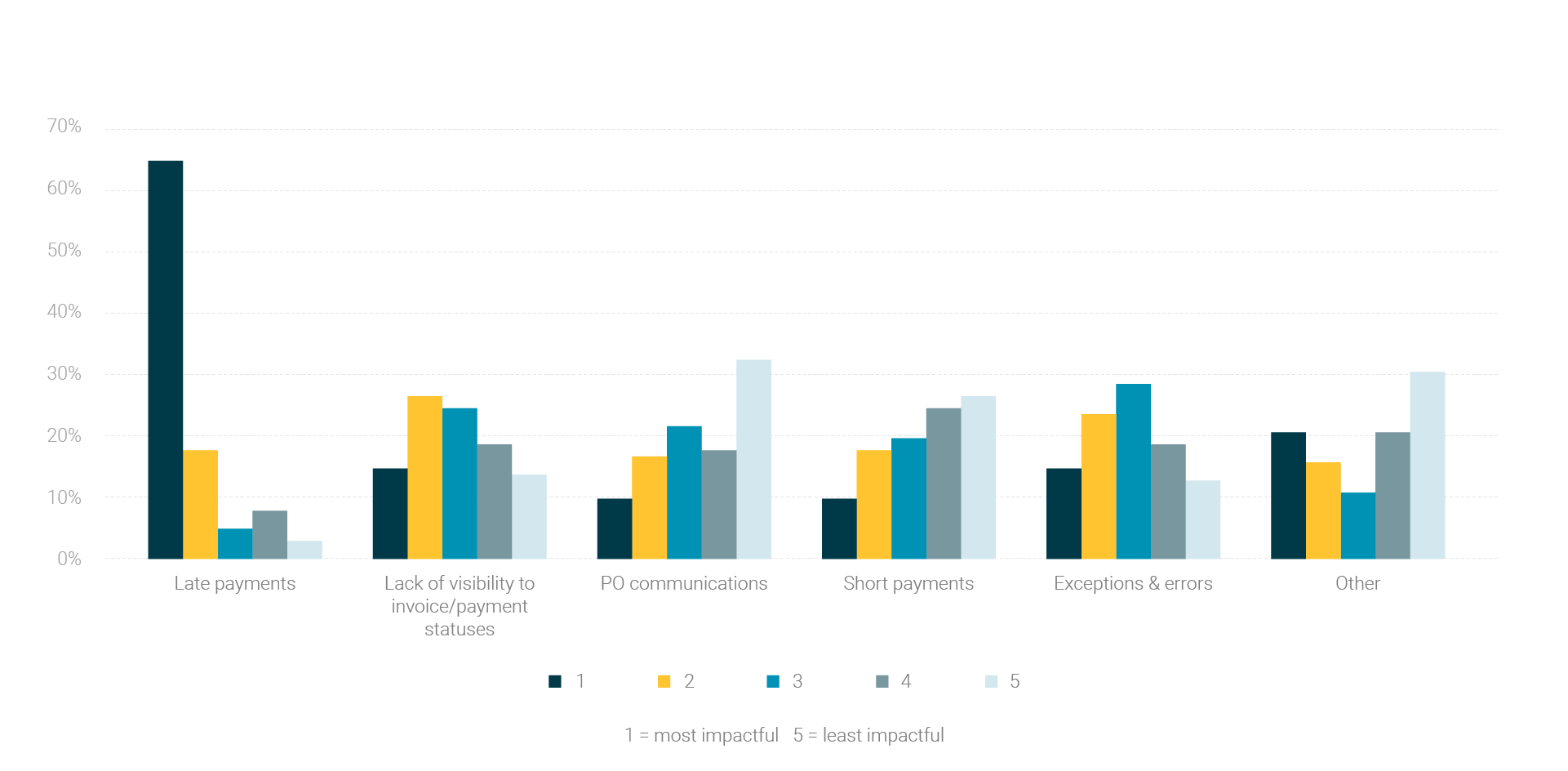

- Late payments, lack of visibility and match exception errors top the list of healthcare suppliers’ accounts receivable (AR) pain points.

- Manual invoicing and payment processes used by far too many suppliers and their healthcare provider customers are largely the cause.

- Digitized e-invoicing and e-payables processes can help solve this by cutting down on errors and optimizing efficiencies on both sides of the healthcare supply chain.

For more on this topic:

- Check out the Remitra® AR automation capabilities.

- Discover the cost benefits of AR automation for healthcare suppliers.

Procure-to-pay (P2P) – the process of requisition, ordering, receiving and paying for products and services – is essential to every business in commerce so it should be a simple business practice, right? It can be, especially for those organizations that have embraced the power and efficiency of automated, data- and technology-driven opens in a new tab accounts payable (AP) and accounts receivable (AR) processes.

But for those that haven’t, like the overwhelming majority of organizations in the healthcare industry that continue to rely on manual invoicing and payment transactions (think email PDF and snail mail paper), the P2P process isn’t simple. In fact, it’s unnecessarily complex and riddled with errors.

Healthcare P2P processes largely run on paper opens in a new tab and PDFs, and they are alarmingly powered by human hands. Despite the best intentions, human intervention often complicates, and frequently compromises, the healthcare supply chain. Paper- and PDF-based transactions are:

- Less efficient than an automated e-invoicing and e-payables solution.

- Manually keyed, making them prone to human error starting at order origination through invoicing and payment.

- Costly for the healthcare industry in terms of both time and money.

- Unsecure and much more susceptible to fraud and theft.

How is the lack of P2P automation adoption in the healthcare industry affecting suppliers?

The team behind Remitra surveyed 158 U.S.-based healthcare suppliers to find out.

We asked the suppliers about their top P2P pain points. Here’s a snapshot of what they told us:

Source: Remitra data as of November 2021

Let’s deep dive into the top three.

Number 1: Late Payments

Of the respondents, 66 percent indicated late payments were their biggest AR problem and nearly one in three surveyed said that 20 percent of their invoices are past due.

Manual invoicing and payment processes clearly contribute to these issues. PINC AI™ opens in a new tab data indicates they can delay payment to suppliers in some instances by 120-180 days1. Factor in an invoice that has error, which leads to an average delay of 64 days in closing the order and getting the supplier paid2 according to PINC AI™ data, and it’s no wonder suppliers are frustrated with paper and PDFs!

P2P automation can alleviate this, helping healthcare suppliers get paid on time.

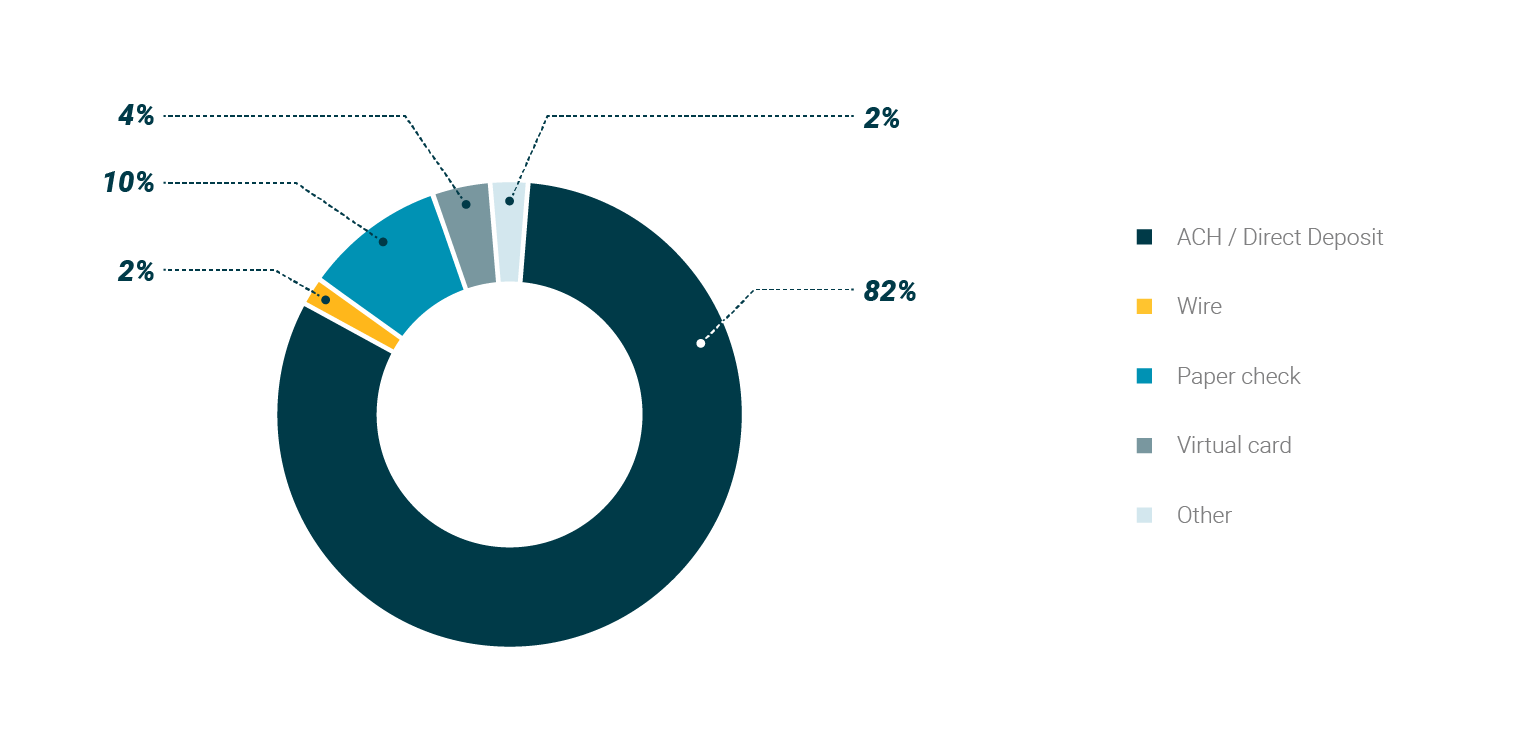

Paper checks, which can get lost in the mail, damaged or intercepted, duplicated or rerouted, are replaced with reliable e-payment (EPay) solutions such as automated clearing house (ACH) and virtual credit cards. These electronic payments are delivered directly from a healthcare organization’s enterprise resource planning (ERP) platform to the supplier’s integrated platform for automatic processing and reconciliation.

According to our survey, an overwhelming 82 percent of suppliers prefer ACH and direct deposit over PDF and paper-based methods; however, PINC AI™ data shows that paper checks are still used up to 85 percent of the time3, adding more to suppliers’ frustration.

Preferred Payment Methods

Source: Remitra data as of November 2021

Number Two: Lack of Visibility to Invoice/Payment Statuses

Coming in second on the list of suppliers’ pain points is the inability to see where invoices and payments are along the P2P continuum, with 27 percent reporting it as highly impactful to their businesses.

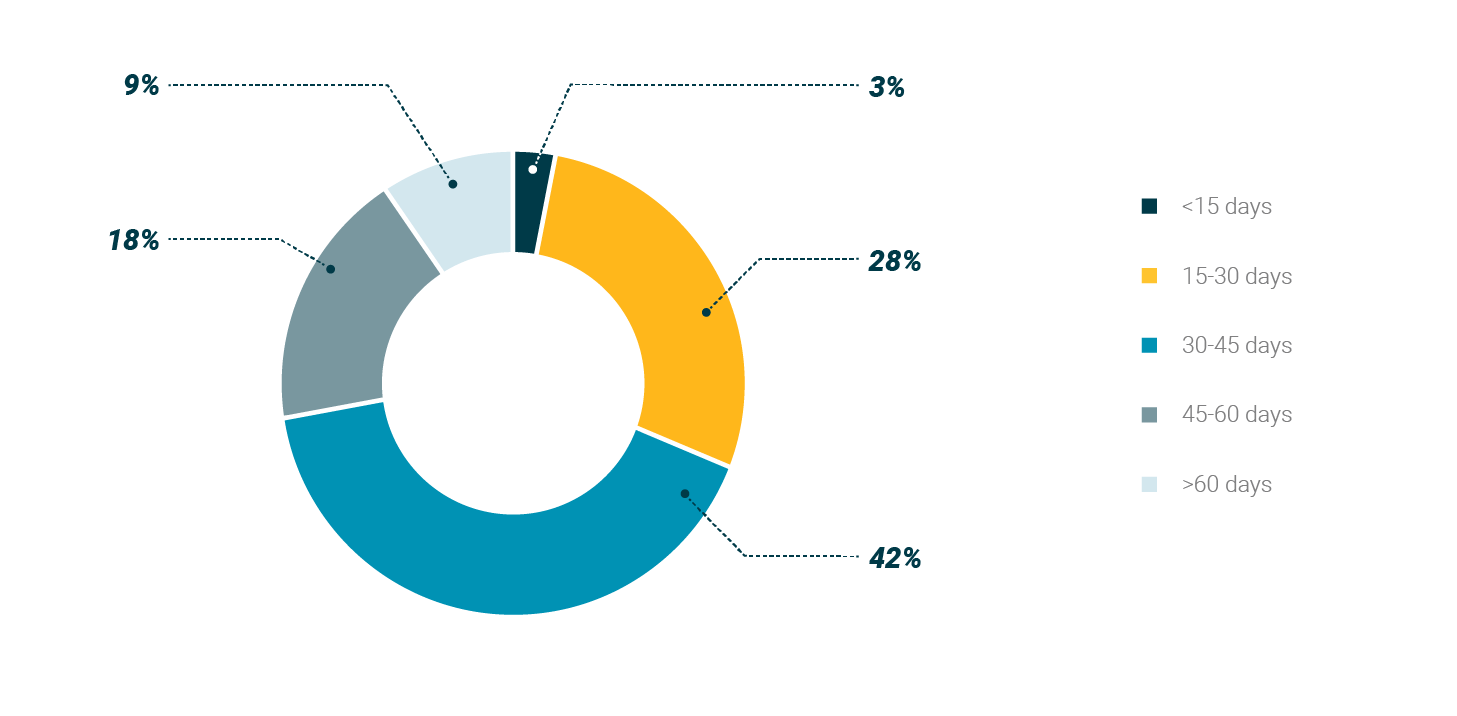

Not knowing the status of invoices and payments can lead to longer days sales outstanding (DSO), which is the time it takes a supplier to convert invoices to cash, resulting in unpredictable cash flow. When asked about their average DSO, nearly half (42 percent) of surveyed suppliers reported a timeframe of 30-45 days while ~30 percent reported 45 days or longer.

Average DSO

Source: Remitra data as of November 2021

The financial roller coaster created by this lack of visibility into their receivables not only makes it difficult for suppliers to fund short-term business expenses, but also to plan ahead for bigger ticket items that help expand production, launch new products and contribute to a more robust supply chain.

P2P automation gives suppliers better control over their receivables by providing the visibility and transparency they need to help lower DSO, increase the predictability of working capital and improve overall financial performance. With an automated platform, suppliers can easily look up and track invoices and payments on-demand 24/7 as well as extract payment details for on-the-spot AR reconciliation.

Number Three: Exceptions and Errors

Match exception errors round out the top three supplier P2P pain points, with 29 percent of respondents reporting them as impactful to their AR processes.

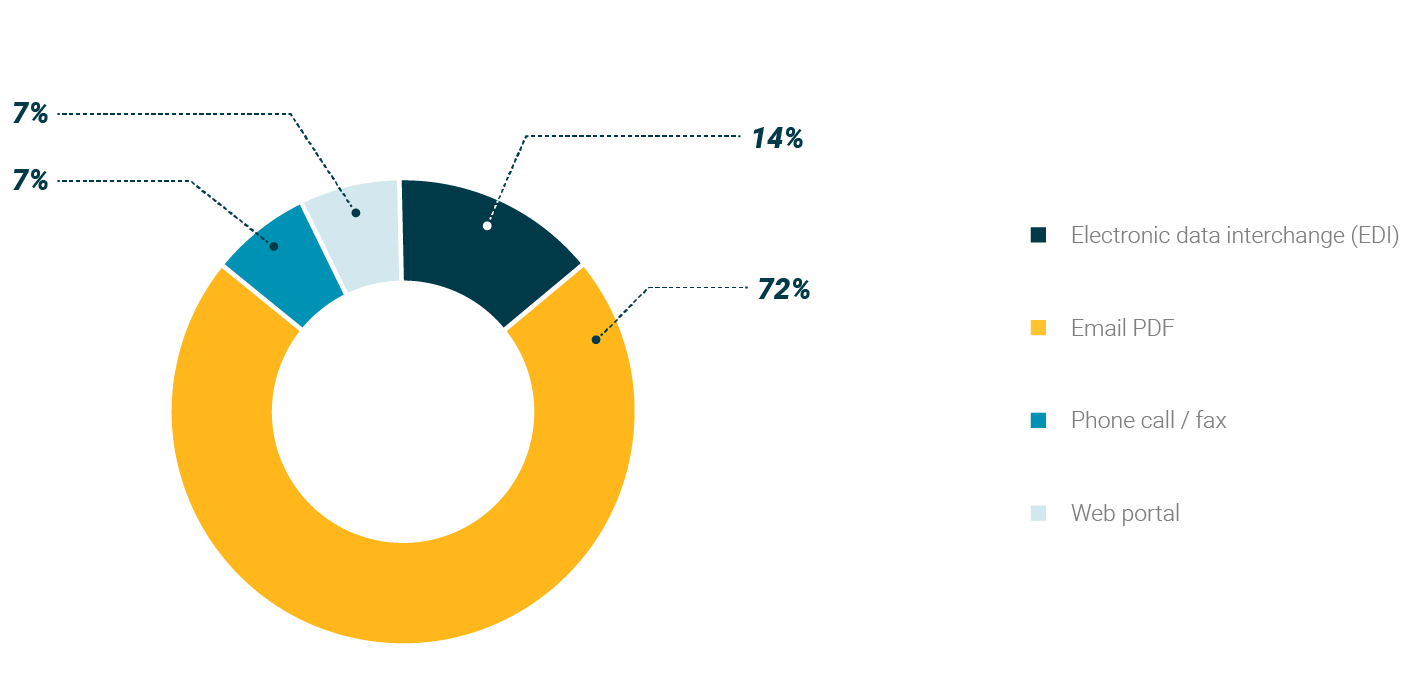

Match exceptions occur when a healthcare organization’s purchase order (PO) fails to match up with a supplier’s invoice, most often as a result of PDF/paper-based methods and/or human error made somewhere along the P2P journey. Our survey data indicates that PDF PO and invoice methods are the most frequently utilized (72 percent of POs and 74 percent of invoices), even though PDFs put the P2P process at risk for errors.

PO Receipt Methods

Source: Remitra data as of November 2021

Invoice Sending Methods

Match exception errors come at a cost in that they pull paperwork out of the normal processing queue, prevent payment to the supplier and create excess work to manually fix, with PINC AI™ data suggesting that 5-15 percent of invoices contain these errors4.

Exception rates can be drastically reduced by using P2P automation.

Harnessing the power of artificial intelligence (AI) and electronic data interchange (EDI) technology – which standardizes and communicates business information electronically, helping to cut down on errors – P2P automation processes most invoices straight through. Those that have exceptions can get the attention they need quickly, as the technology enables suppliers to receive early notification of errors that need to be resolved.

The Bottom Line

P2P automation is helping to solve healthcare suppliers’ biggest pain points, providing them with a tech-driven means to conduct business more efficiently with their customers, securing and speeding up their payments, and freeing up cash flow to keep their operations running smoothly.

The real issue is getting more suppliers and healthcare organizations on board to reap the benefits of automation as our survey data above shows only 14 percent of suppliers surveyed receive POs via an EDI connection and even fewer use the technology to send invoices (11 percent).

As an industry, it’s time we stop drowning in manual, PDF- and paper-based AR processes and start modernizing with P2P automation.

Stay tuned for a follow-up blog where we’ll deep dive into the current state of P2P from the other side of the healthcare supply chain – hospitals, health systems and all in the continuum of care.

References:

- Based on PINC AI™ data. Accurate as of February 2021.

- Ibid.

- Ibid.

- Ibid.