Key takeaways: Aligning payments to suppliers with reimbursements from payers is critical for healthcare organizations…

Still Paying with Checks in Healthcare Supply Chain? Here are Five Reasons to Go Digital.

Key takeaways:

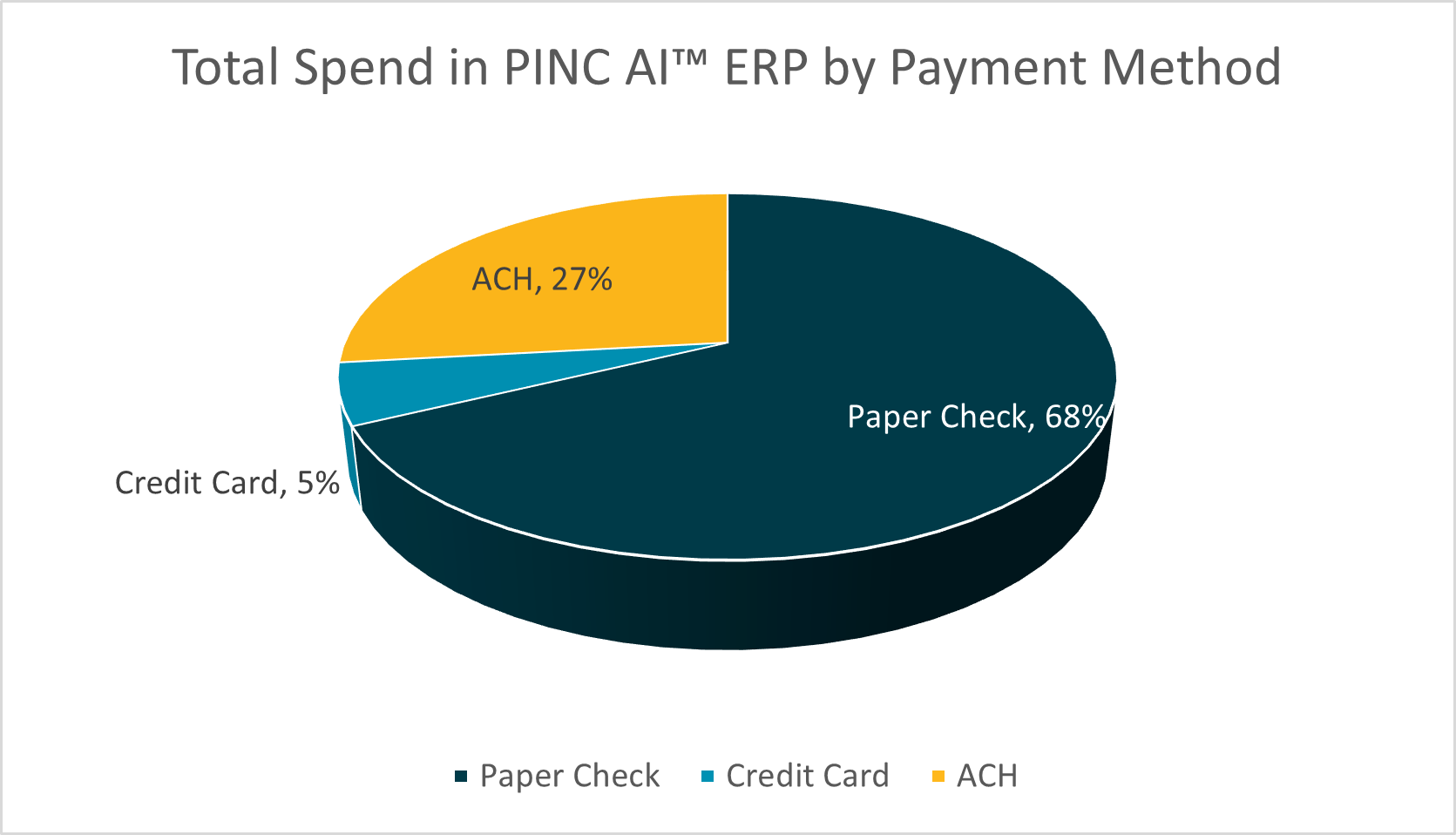

- New PINC AI™ data shows that as recently as February 2022, healthcare providers, on average, were still levering paper checks for 68 percent of their payments to suppliers.

- Although there’s been a focused effort and declaration by most health systems to improve digital penetration, the statistics don’t support that it’s occurring with payment, as we have only seen a slight decline (less than 10 percent) through the COVID-19 pandemic.

- Digital payment methods are more efficient than paper checks, offering healthcare organizations at least five valuable reasons to make the switch.

For more on this topic:

- Learn about the opportunities Remitra’s automated AP platform opens in a new tab offers to healthcare organizations to maximize efficiencies and minimize waste.

- Evaluate your organization’s potential savings opens in a new tab by automating manual AP processes.

- Check out our white paper opens in a new tab that details how technology can benefit the healthcare supply chain.

With one recent study opens in a new tab indicating companies are increasingly making the transition from paper checks to digital payment methods – and discovering the benefits digitization brings opens in a new tab to accounts payable (AP) processes – new PINC AI™ opens in a new tab data suggests the healthcare industry is slowly making progress but still lags significantly in adoption.

Given the pressures companies were put under during the COVID-19 pandemic to innovate and accelerate back-office digitization due to remote work and other mandates, these latest findings speak to our latency, as an industry, in adopting modern technology integrations that lead to significant inefficiencies in operations and in finance.

The data below (as of February 2022) represents $19B in spend across 80 disparate health systems that utilize PINC AI™ enterprise resource planning (ERP) technology in their supply chains. It shows these organizations’ total supply chain spend is via paper check 68 percent of the time despite the availability of modern methods such as Automated Clearing House (ACH – used 27 percent of the time) and credit card (used 5 percent of the time).

PINC AI™ data pulled one year prior (February 2021) from the ERP system indicated up to 85 percent of healthcare purchasing was being done manually via paper checks with the average hovering closer to 70 percent. These healthcare organizations have improved roughly 5 percent over the 12-month period, but there are still systems that are north of 80 percent when it comes to paying suppliers by check.

The data may provide just a snapshot of what’s happening overall in the healthcare industry, yet the insights gleaned suggest there’s significant work to be done to digitize AP workflows and realize the benefits industrywide.

You might be saying to yourself, “What’s the problem with paper checks? They’ve been around forever.” While it’s true that the old-fashioned check has stood the test of time, change is on the horizon with some analysts suggesting that the paper check will be extinct opens in a new tab by 2026.

Here are five reasons to put the checkbook away for good and start embracing the power of AP automation in your organization’s healthcare supply chain.

Maximize your workforce. AP automation acts as a labor extender in your supply chain. This is critically important given that the healthcare industry is experiencing record staffing shortfalls and high labor costs, emphasizing the need to ‘work smarter, not harder’ organization wide. In fact, in Premier’s recent CEO survey, nearly eight in 10 surveyed executives indicated “labor” is their number one concern in 2022. This statistic was the largest aggregation of providers focused on a single topic we have ever seen in a survey, including the topic of “COVID-19,” which represented seven out of 10 surveyed executives.

By digitizing back-office functions that are mired in manual, paper-based invoicing and payment processes, a health system’s labor force is extended, freeing up employees to be more productive and to focus on value-added, strategic opportunities that contribute to the delivery of patient care and the organization’s overall bottom line.

Reduce waste and expense. One of the biggest benefits of going digital with your AP processes is that it saves both time and money opens in a new tab. Estimates show that it costs an organization opens in a new tab between $4 and $20 to cut just one check. A significant portion of this cost can be attributed to the time it takes employees to manage the paper trail that’s created – from filling out the check to putting it in an envelope, addressing and stamping it to reconciliation. What’s more, manual check handling is prone to human error and other costly inefficiencies. AP automation can solve these issues by eliminating human intervention and processing payments straight through.

Minimize opportunities for check fraud and theft. Paper checks aren’t just wasteful and inefficient, they pose a security risk as well. With each check your organization sends out, you’re also sending out sensitive data like the name of your banking institution, bank routing number and account number that could all wind up in the hands of thieves. In addition to being stolen, paper checks can be forged or get lost in the mail, never making it to the suppliers you’ve intended them for. The chances of fraud and theft can be reduced through AP automation.

Ensure receipt of critical supplies needed by clinicians. When suppliers aren’t paid in a timely manner, you run the risk that supplies needed for patient care won’t make it into the hands of clinicians in a timely manner. AP automation replaces paper checks with digital payment options that are sent from your organization’s ERP system directly to a supplier’s integrated system. The technology helps to ensure your payments are delivered on time, every time, which in turn, helps to ensure your supplies are received on time, every time.

Enhance relationships with suppliers. A recent survey of healthcare suppliers opens in a new tab conducted by Remitra revealed top pain points experienced as a result of the lack of automation employed in healthcare purchasing. Respondents pointed to errors and exceptions caused by human intervention as well as late payments and lack of visibility into their receivables as major sources of frustration, putting a strain on their customer relationships. Automation is the answer to easing that strain, helping suppliers and healthcare providers conduct business more efficiently and effectively.

Not convinced AP automation is the way to go in your healthcare organization?

See what experts from both sides of the healthcare supply chain had to say about how AP automation is helping to drive savings, revenue and more opens in a new tab in their organizations.

About the Authors

Chaun Powell

Group Vice President, E-Invoicing & Payables, Remitra

Chaun is responsible for providing leadership, strategy and execution to tech-enable critical supply chain purchasing processes.

Sophia Barnes

Remitra EIPP Manager

Sophia manages and supports the e-payables, duplicate payments and missed credit recovery services for Remitra. In her previous position with Premier, Sophia was the PHSI Supervisor for Cash Applications and AR Collections, responsible for the establishment of a collaborative cross-functional network for the AR analyst and the cash application team to quickly apply payments, identify over-payments and duplicate payments, and reduce customer invoice days sales outstanding (DSO).