Key takeaways: Aligning payments to suppliers with reimbursements from payers is critical for healthcare organizations…

Automation: The Secret to Improving DSO and DPO in Healthcare Supply Chain

Key takeaways:

- Longer days sales outstanding (DSO) and longer days payables outstanding (DPO) negatively impact the financial health and operational capabilities of both healthcare providers and suppliers.

- Recent surveys conducted by the Remitra® team reveal the majority of providers, regardless of size, have DPOs that exceed the contract terms which, in turn, lead to extended DSOs for suppliers.

- Automation in supply chain can help speed up both collection and payment, improving DSO and DPO for all parties involved.

For more on this topic:

- See how Remitra solutions are helping automate healthcare supply chain accounts payable (AP) and accounts receivable (AR) processes and shorten providers’ DPO and suppliers’ DSO.

- Hear from industry experts in a recent webinar opens in a new tab on how automation is driving savings, revenue and more in their organizations.

- Evaluate your organization’s potential ROI opens in a new tab by automating supply chain purchasing processes.

We all know the phrase “time is money.” And in healthcare purchasing, specifically when looking at days sales outstanding (DSO) and days payables outstanding (DPO), the phrase couldn’t be truer. DSO is the time it takes a supplier to convert invoices to cash and DPO is the time it takes a healthcare provider to pay its suppliers.

These measures of time are heavily intertwined with economic effects that can significantly impact business on both sides of the healthcare supply chain – including cash flow, revenue and credit worthiness to name a few. A longer DSO can affect a company’s ability to invest in future growth, and a longer DPO can affect a healthcare organization’s ability to deliver quality patient care opens in a new tab.

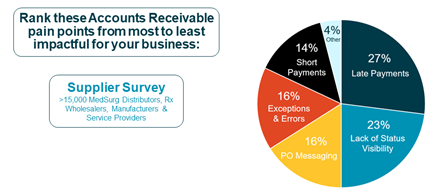

To get a finger on the pulse of DSO and DPO in healthcare supply chain, the Remitra team recently surveyed healthcare suppliers opens in a new tab and providers. On the supplier side, we asked about the pain points experienced with current accounts payable (AP) and accounts receivable (AR) processes and found that “late payments” is the number one source of suppliers’ pain.

Ironically, only 16 percent of those surveyed identified the root cause of these delays, match exceptions, as their primary pain point. Like so many other areas of healthcare, the industry is focused on treating the symptoms rather than addressing the cause.

Remitra data as of November 2021

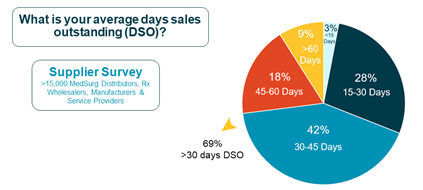

As a result of late payments, suppliers are forced into longer periods of DSO, with 69 percent of respondents reporting DSO greater than 30 days.

Remitra data as of November 2021

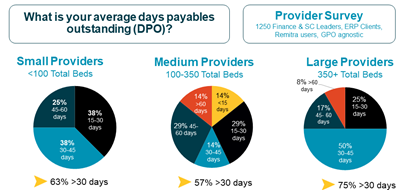

In our provider survey, we asked different-sized hospitals about their average DPO. Of the small hospitals (less than 100 beds) surveyed, 63 percent reported DPO greater than 30 days. Of the medium hospitals (100-300 beds), the number is slightly lower, but still high at 57 percent. And of the large, multi-state providers (350 or more beds) surveyed, DPO greater than 30 days is the highest at 75 percent.

Remitra data as of March 2022

A longer DPO comes with negative connotations. It implies that a healthcare organization has difficulty meeting its invoices on time and has poor cash flow. On the other hand, a shorter DPO shows a healthcare organization’s ability to pay off its credit on time and has a steady cash flow.

How can providers improve their DPO which, in turn, will help to improve suppliers’ DSO? In a word: Automation.

One of the biggest obstacles to improving DPO and DSO in healthcare supply chain is the proliferation of manual, paper-based processes opens in a new tab still used industry wide despite the availability of cloud-based, automated ordering, invoicing and payment solutions.

Take a moment to think about your own organization’s procure-to-pay (P2P) process.

- How do you send purchase orders (POs) to suppliers?

- Is it via phone call or fax? Or perhaps email PDF?

- Are you receiving invoices from suppliers in the same manner?

- How about making payments?

- Do you cut and mail paper checks to suppliers?

These antiquated P2P processes create numerous challenges that are time and labor intensive, not to mention costly, leading to longer DPO and DSO. Paper POs, email PDFs, faxes and snail mail invoices and checks create:

- Manual data entry and excessive work for AP and AR departments.

- Lengthy approval processes.

- Opportunities for duplicate payments and payment errors.

- Opportunities for check fraud and theft opens in a new tab.

When providers and suppliers replace manual AP and AR processes with one digitized, automated platform like Remitra, these challenges can be resolved, speeding up both collection and payment.

Here’s how the Remitra platform, using the power of automation, helps to eliminate paper, reduce complexities and optimize financial processes for improved DPO and DSO.

- Digitize invoices. Using optimal character recognition (OCR) technology, the Remitra platform can take an invoice in any form, digitize it and standardize it for automated, hands-free processing. This removes a tremendous, time-consuming burden of manual data entry from the AP department. It also reduces administrative costs and lessens the chance for data entry and other errors in supply chain management.

- Sync up providers’ AP and suppliers’ AR. When a provider’s PO fails to match up with a supplier’s invoice, an exception occurs, which creates extra work for the AP team to resolve and delays prompt and accurate payment to the supplier. The Remitra platform integrates a provider’s enterprise resource planning (ERP) system with the supplier’s system so all pricing data flows seamlessly between the two and any price discrepancies can be caught and corrected before making it to the invoicing stage.

- Digitize payments. The Remitra platform eliminates expensive paper checks, replacing them with safer, more cost-effective digital payment options such as virtual credit card and automated clearing house (ACH). Digital options not only cut down on waste and expense, they also minimize opportunities for fraud and theft and help to ensure payments are delivered on time as they’re transmitted directly from the provider’s ERP system to the supplier’s system.

Faster, more accurate hands-free transactions. Predictability and faster receipt of payment. A simplified, more efficient P2P process for healthcare organizations and their suppliers. Time truly is money in healthcare supply chain, and automation is the key to making the most of it, leading to improved DPO and DSO.

About the Authors

Chaun Powell

Group Vice President, E-Invoicing & Payables, Remitra

Chaun is responsible for providing leadership, strategy and execution to tech-enable critical supply chain purchasing processes.

Sophia Barnes

Remitra EIPP Manager

Sophia manages and supports the e-payables, duplicate payments and missed credit recovery services for Remitra. In her previous position with Premier, Sophia was the PHSI Supervisor for Cash Applications and AR Collections, responsible for the establishment of a collaborative cross-functional network for the AR analyst and the cash application team to quickly apply payments, identify over-payments and duplicate payments, and reduce customer invoice days sales outstanding (DSO).